A growing trend in crypto is protocols earning revenue from users paying fees, aka “real yield,” not just arbitrarily inflating the token supply.

🧵 with quick and dirty math on one perspective for how the market is currently pricing those earnings.

Chart from @tokenterminal

👇

First, a disclaimer that these “earnings” are not equal to one another and not quite equivalent to the earnings of a company. Some earnings are dividends but others are token burns, etc.

Even so, I think it’s interesting to take TradFi metrics and apply them to crypto assets.

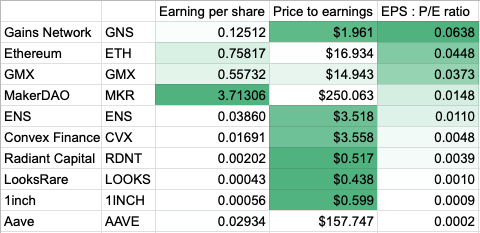

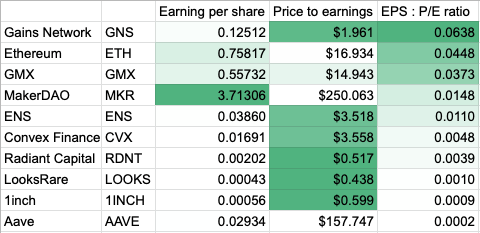

So, using some rough metrics used to value stocks…

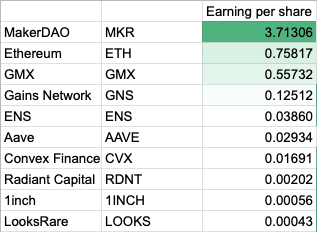

Earnings per Share = net protocol fees earned divided by total token supply

☝️ shows absolute (net) earnings

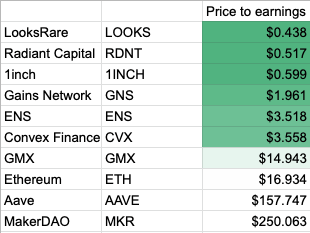

Price to Earnings = current market price divided by Earnings per Share

☝️shows the current market value of earnings

Here are the top 3 protocols by Earnings per Share:

1) $MKR

2) $ETH

3) $GMX

Here are the 3 protocols with the lowest Price to Earnings:

1) $LOOKS

2) $RDNT

3) $1INCH

A high EPS and low P/E is generally good combo.

It **could** indicate an asset is **relatively** undervalued on the basis of a discounted cashflow valuation.

Putting it all together, here are the top 3 by a ratio of EPS and P/E (high EPS, low P/E):

1) $GNS

2) $ETH

3) $GMX

It will be interesting to see further analysis and valuation frameworks develop as more protocols earn fees.

Our fund, Cosimo Capital, is very interested in novel valuation models for crypto native assets. Feel free to give us a shout!

Originally tweeted by jack miller (@john_iller) on March 8, 2023.