Quick thread on the Tezos $XTZ baking ecosystem.

Like other blockchain systems, Tezos acts like a faucet that drips money and the incentives end up fueling an organic ecosystem.

👇

What is Baking?

See this thread – despite Twitter deleting the first tweet for some reason AHEM @TwitterSupport

https://twitter.com/john_iller/status/1197984643317940231

TL;DR -Baking == staking. Bakers deposit Tezos, perform technical tasks (run software on dedicated hardware), and you earn a small reward.

TL;DR part 2 – why should I care about this?

Yield

You can buy $XTZ and earn 5-6% per year (paid in $XTZ) by baking. The rewards come from inflation of the $XTZ supply, thus if you hold $XTZ and don’t bake, you’re leaving money on the table and getting inflated away.

But you don’t have to do any of the hard work yourself. If you just want the yield, you can let someone else do the baking (for a small cut of the profits) and you can just collect the returns. With some caveats…

The Setup

Most people bake with a third party for convenience. A key feature is that Tezos allows you to “delegate” staking duty to a third party such that they cannot steal your money. At worst, they could lose/steal your rewards, but they can’t touch the principal.

How could they steal your rewards? The Tezos protocol pays the baker ALL the rewards, which means you have to trust the bakers to actually pay them out to their delegators. Luckily, Tezos is a public ledger so we can monitor these payments.

This might seem like an odd choice for Tezos, but this allows greater flexibility. Most bakers simply charge a flat fee. But what a baker wanted to charge a fee that decays over time to reward their long-term, OG delegators? etc. I bet we see many innovative models appear.

What Does the Ecosystem Look Like?

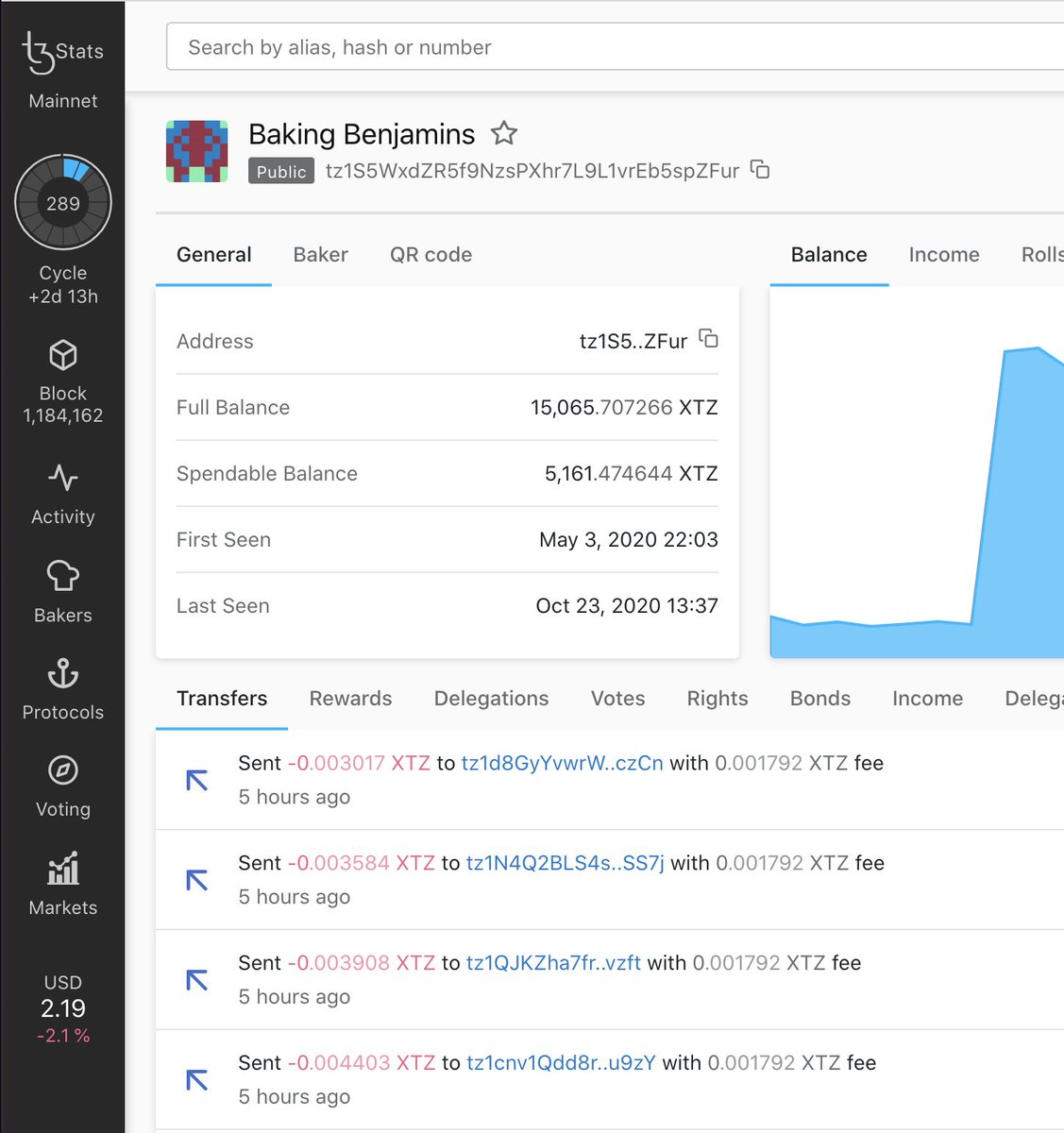

According to https://tzstats.com @tzstats there are 415 active bakers. See this thread for an old but more granular breakdown of the different types of bakers

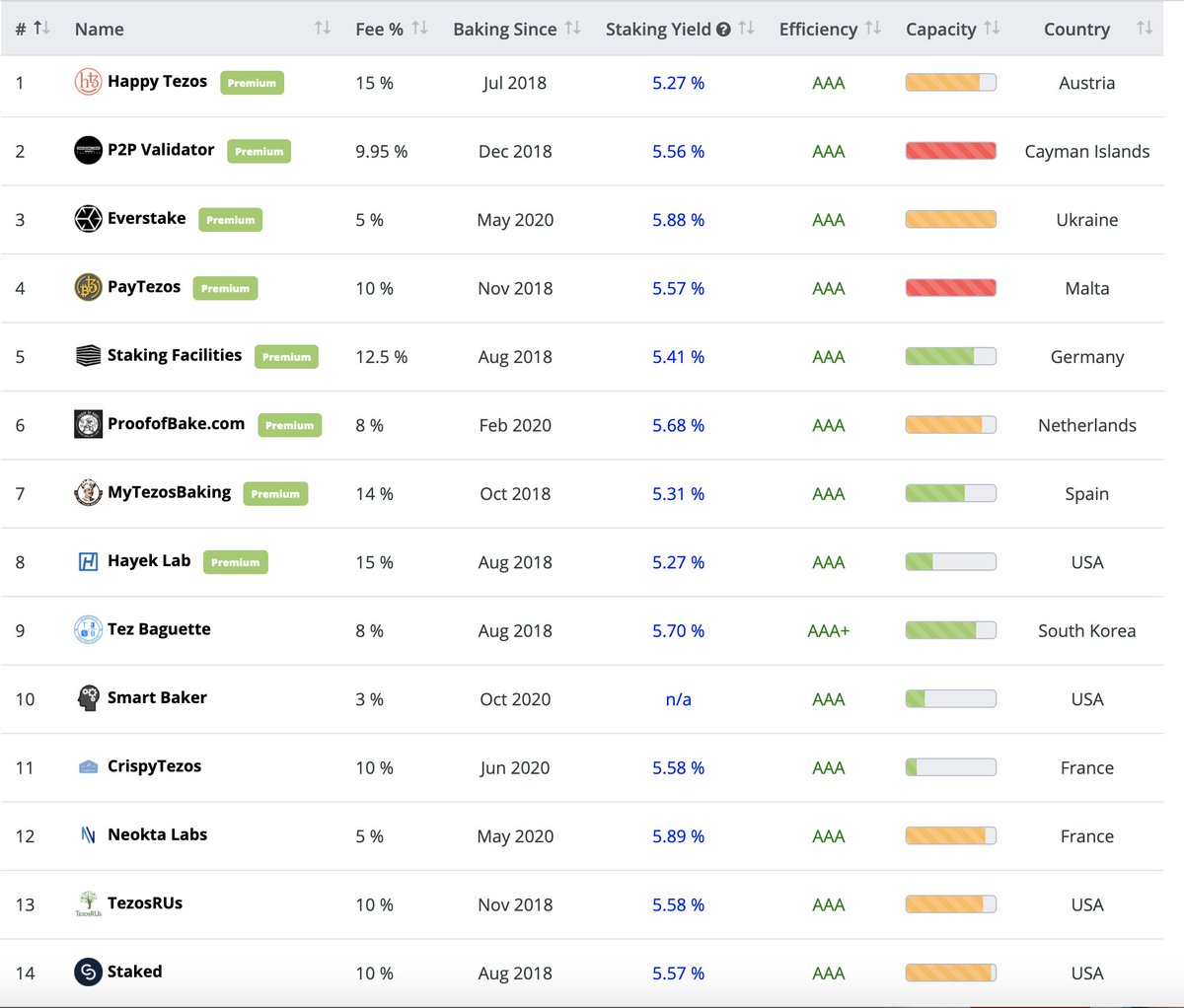

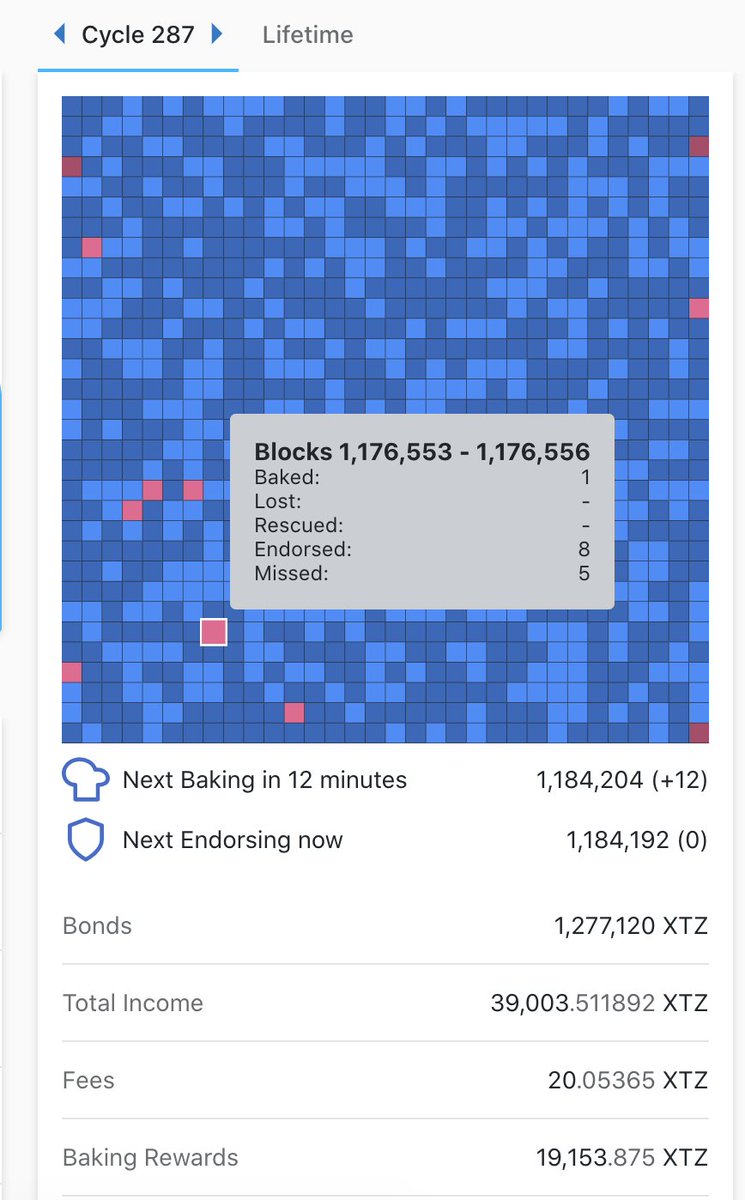

Interestingly, all bakers perform the exact same tasks. So what differentiates one service provider over another? Bakers compete on track record, fees, and brand. At first glance, fees might seems like the most important metric but reliability is WAY more important. Why? Because missed payments hurt so badly. By design, you don’t see your first baking payment for 12 “cycles” or ~5 weeks, due to a built-in delay and the nature of deposits. You risk getting ripped off and not knowing it for 5 weeks or much longer if you’re not vigilant.

Napkin Math

You have 100 $XTZ. A good baker with a 3% fee earns you 6 $XTZ per year and a baker with a 10% fee earns you 5.58 $XTZ. If 3% doesn’t pay out the last 5 weeks of the year, you only earn ~5.42 $XTZ. And that’s a very “optimistic” case for losing rewards.

The Solution

We can monitor the Tezos network and thus the bakers, directly. Third parties such as @TezosBakingBad , @mytezosbaker, @TezosNodes have popped up to make this process simple for end users.

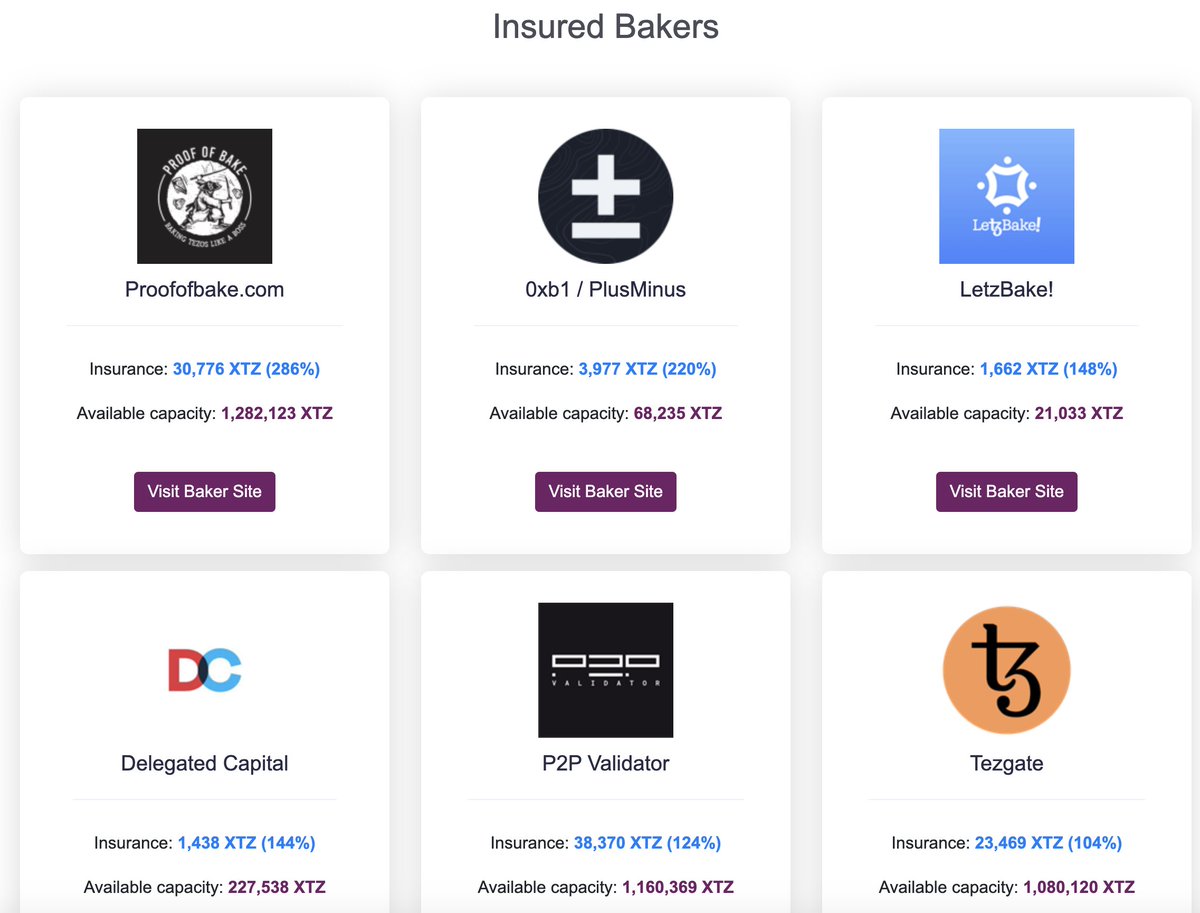

@TezosBakingBad takes this a step further and offers baking insurance. Bakers pre-pay an insurance fund held by Baking Bad who would distribute rewards if a baker stops paying or performance drops too low.

To my knowledge, this has not yet occurred.

Fees

The current conventional wisdom is to pick a baker with a good track record and 10% fees or so. While some bakers offer much lower fees, lower fee bakers are perceived to be less trustworthy, with a higher incentive to cheat.

Track Record

Using the various third parties listed above, you want to know that the baker performs the baking tasks at near 100% performance, pays out their delegators on-time, and never miss a payment.

(“performance” of the baking tasks is auditable on-chain as well)

Brand

Most bakers have some sort of baking-related pun in their name, but brand is more about trust and governance. Bakers vote on behalf of their delegators, so you should pick a baker that will vote in your interest. This is another reason we want a diverse baker ecosystem. Keep an eye out for red flags. Consider the quality of their website, whether they are a known entity, and whether you can actually contact them. Obviously you may also prefer an insured baker if you possible which lessens the need to rely on branding, overall.

Also, there is another class of baker – exchanges. They are distinct from other bakers because they are custodial – they hold all your Tezos for you. Some people like the convenience, others want to hold their keys and their money themselves. Tradeoffs with everything.

A Growing Ecosystem

This ecosystem grew completely organically but Tezos did two key things to facilitate this –

1) drip incentives

2) trust-minimized protocol rules that enable service providers

(i.e. bakers can’t steal your principal. Otherwise, it would be too risky to trust internet randos)

Contrast this the real world – enforcing rules is messy and usually requires the threat of violence by a government, otherwise a thief could “win.” In the digital world, you can construct systems such that it’s simply impossible to cheat, or if you cheat then you can only lose. Just look at Bitcoin mining for an example of dripping incentives creating an entire industry. Tezos baking is steadily growing year after year.

Originally tweeted by jack miller (@john_iller) on October 23, 2020.