Below is an unrolled version of this tweet thread – https://twitter.com/john_iller/status/1197984643317940231 – which correctly predicted that the Tezos staking tokenomics would mean that exchanges would have to buy more Tezos.

PS Twitter deleted the initial tweet to start the thread for no reason at all.

Tezos Staking and Upcoming Supply Shock

Tezos is the largest proof of stake ecosystem in crypto and is seeing increased adoption by large exchanges as a way for users to earn yield. Below is a thread that gives overview of the staking ecosystem and why I believe the staking industry will continue to grow.

We also predict an upcoming supply shock in Tezos as the major exchanges need to buy A LOT of Tezos to keep their staking services running.

Staking is called “baking” in Tezos. You can earn ~6% XTZ / year. 70+% of XTZ staked. Most users delegate to a baking service and pay a % fee on rewards (5% – 25% fee), like using a mining pool.

Baking Service Economics

Bakers put down a deposit and then users can join their service. “Capacity” is limited to ~8x your initial deposit. This means if you have more than ~8x XTZ worth of user funds using your service, there are not enough rewards to go around, meaning users (and thus bakers) miss out on revenue. Only way to capture this otherwise missed revenue is add more XTZ to your initial deposit.

Exchanges Getting Involved

Coinbase launched a baking product recently. Binance, Kraken, et al. will follow. On-chain data shows demand for baking is steadily increasing. Exchanges must own a large initial deposit and are thus long XTZ.

NOTE: one reason demand increasing is Coinbase itself. They make baking with them stupid simple and they automatically start baking for you if you have > 500 XTZ. They charge a hefty fee for this (25% of rewards).

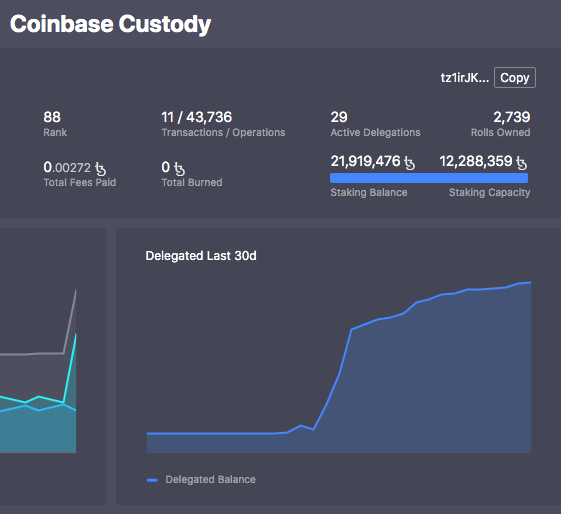

Coinbase Already Over-Subscribed

Coinbase Custody is over-subscribed by 15,557,014 XTZ. They need about ~2 million tezzies ASAP to be able to pay out all delegated users. They will also have an insufficient security deposit for their existing users in 4 cycles (12 days).

Increasing Demand

Coinbase and other exchanges must buy millions of XTZ and they are naturally long. User demand for baking is increasing and baking users are long as well.

E.g. Coinbase initial deposit is ~672,000 XTZ. http://Gate.io‘s is 5 million XTZ. Luke Youngblood says Coinbase will only use Coinbase funds as initial deposit.

They have to buy XTZ to make their product work and capture revenue.

Small Available Supply

70+% already locked up in baking. The trading volume on Coinbase is ~$7 million / day. New issuance for XTZ is ~$40 million / year which mostly goes to bakers who are long. There is simply very little available XTZ for selling.

The End

The bottom line is this – people need to buy and hold a lot of XTZ to earn revenue through baking, which is growing in demand and profitability.

Feb 14, 2020 update

Wild times for Tezos. Since last time:

* Binance and at least 3 other major exchanges launched XTZ staking

* Coinbase increased their staking bond from 672,110 to 5,321,943

* Coinbase is staking 52 million+ in user funds (140% growth since Nov ’19)

* Largest 3 exchanges alone staking nearly 100,000,000 XTZ (more on this later)

* Price is up 202.69%

* Rewards currently pay out about 6.43% per year

* 78.62% of all XTZ is being staked

More on Exchanges

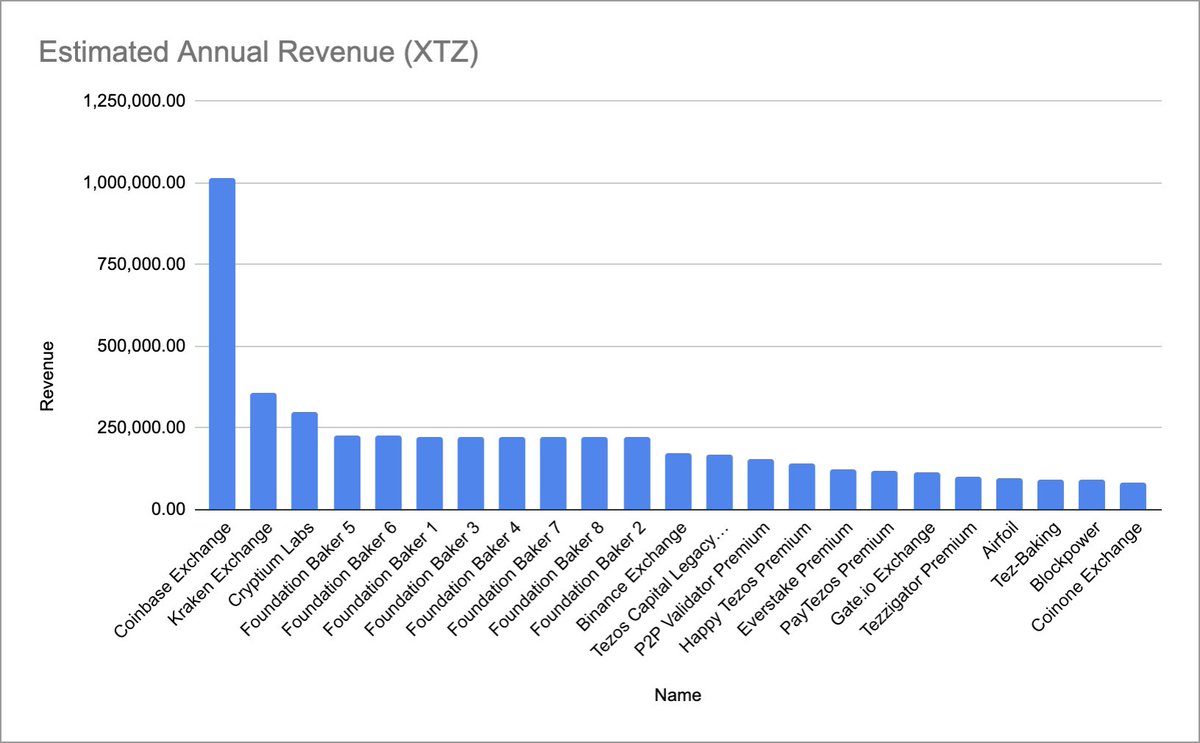

Exchanges staking Tezos is a profitable, growing product. Coinbase leads with >1 million XTZ in revenue per year.

Some exchanges sell off XTZ revenue to maintain a certain balance but all have reliably added to their staking bonds to keep up with user demand.

As a reminder, they must add to their staking bond to fully capture their revenue. If their bond is too low, they risk being unable to fully pay their current customers, thus offering inferior returns and potentially losing marketshare to competitors.

NOTE: many exchanges bake with user funds. This means you might not be able to withdraw your funds if they’re locked up.

Also these funds are technically at risk from slashing in the event of an attack or bad technical error, though this is unlikely to cause significant loss.

Binance

Binance got everyone’s attention when they announced a 0% fee for their staking product.

However, Binance delays their payouts and pays out once a month. Thus they bake with your rewards for a while before they send them to you. This adds an effective fee.

Centralization

All of the above may sound like the network is owned by the Exchange Cartel. I don’t believe this is true, for now. Independent bakers make up the largest segment the baker population, roughly 43% of all bakers.

Centralization by large custodians is a threat to PoS consensus, but there are incentives to using independent bakers.

It’s (generally) cheaper and safer to store your own XTZ and bake with and indie. That said it’s still significantly easier to bake with a custodian, for now.

What’s Next

You may ask “why are you so obsessed with exchanges?” One amazing thing about Bitcoin is it made thousands of people buy specialized computer equipment to mine Bitcoin.

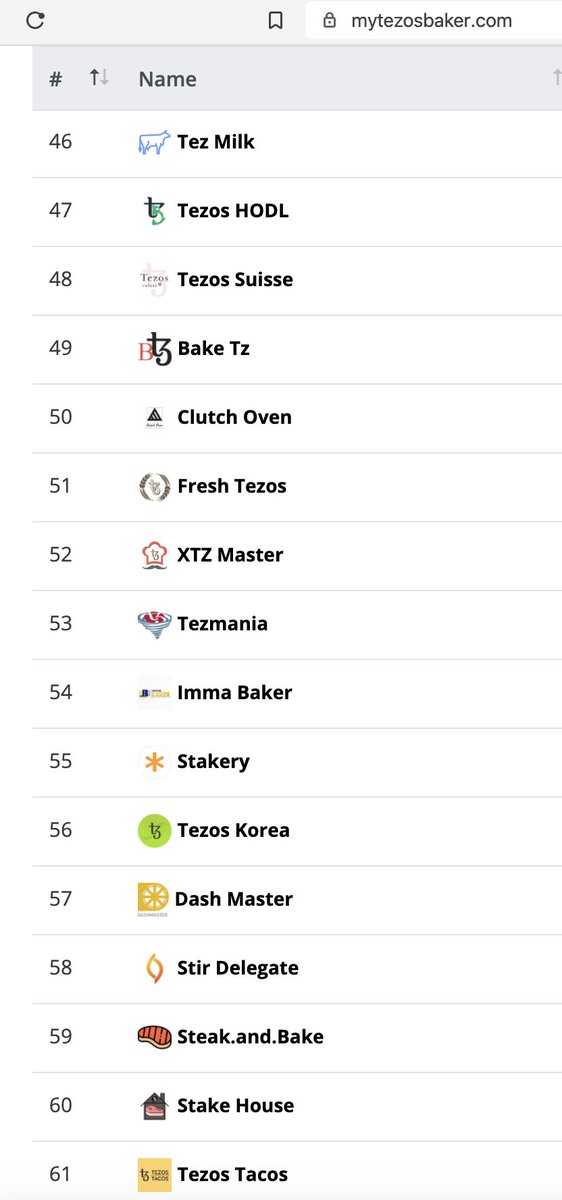

Likewise, Tezos incentivized hundreds of groups of people to spend time and money to perform the technical task of baking and market their “baker” with a cheesy baking pun for a name.

The economic incentives these networks create are powerful motivation for human action.

Now XTZ rewards are incentivizing private companies to invest time, money, and talent to its staking product, which is growing fast. But this is just the beginning. These companies also have venture capital arms. They invest in private companies and open source. They now have a massive interest in the Tezos asset. You could imagine (pure speculation) further product integration like Tezos security (equity) token offerings listed on these exchanges.

I.e. Coinbase is long XTZ. They have a profitable XTZ staking product. They’ve invested in Staked, a company that stakes XTZ (and more).

They’ve invested in open source technology for Tezos as well as for-profit companies. They want to grow their regulated product offerings. XTZ staking is materializing as a profitable product and the biggest exchanges have a large investment behind Tezos.

The incentives are completely aligned and staking shows no sign of slowing down.

THE END

Originally tweeted by jack miller (@john_iller) on November 22, 2019.